If you are searching to own a personal loan and require a giant name when you look at the loans, you could potentially ask yourself in the event the Capital You to definitely personal loans was a choice. The fresh small response is no. There aren’t any Money You to unsecured loans. You’ll find, however, many other available choices. It’s a question of choosing the unsecured loan that suits your situation most readily useful.

Personal loan alternatives in order to Investment That

Right here we’re going to defense alternatives to help you Resource You to definitely unsecured loans that assist you no in the to your kind of financing you are interested in. A personal bank loan is unique — no mortgage is just one size suits all of the. It might take some effort to find the primary financing, however it might be worth it.

Banks

While the sort of individual who desires all of your accounts in a single put, a financial may offer the ideal replacement for Resource One to personal money. Actually, it could have been why your sought out Investment That personal loans before everything else. Consider just how effortless it will be for the savings account, family savings, mastercard, and personal loan all-in the same set. If you have a question throughout the some of these profile, you know who to-name. You can quickly get to know this new bank’s on the internet possibilities and you may availability your entire economic advice at any time.

Marcus is actually an on-line lender which could make a good individual financing solution. Marcus by Goldman Sach’s family savings try competitive, and also the financial offers advanced level unsecured loans. Which have low interest rates and versatile financing quantity, it sticks in order to the slogan from: Zero charges, actually. When you have good credit, it is worth a glimpse.

Borrowing from the bank unions

Borrowing from the bank unions are a great alternative to Funding One to personal loans. Instance a lender, signing up for a card partnership you certainly will allow you to have your examining membership, family savings, bank card, debit card, and personal loan in one place.

As well, a cards connection is more gonna see you because the an excellent human that have a special band of issues. Basically, you aren’t just several. Can you imagine you happen to be worry about-working and secure an irregular income, or your enterprise financing appear to account for a massive element of your earnings. Perhaps you are in the entire process of boosting your credit history. Whatever your situation, a loan administrator in the a cards relationship is far more gonna comprehend the problem.

With 314 towns nationwide, Navy Government Borrowing Union is the prominent borrowing from the bank connection throughout the nation. Navy Government also offers certain fairly competitive personal loans. If you otherwise anyone on your own instantaneous family has offered from inside the this new armed forces, belongs to the newest Company regarding Cover, or perhaps is an element of the defer entryway system, you are qualified to receive four different varieties of signature loans having great rates.

On the web lenders

Searching for several other alternative to Financial support You to personal loans? On line loan providers can get treat your. You get every comfort you had been longing for off Resource One personal loans, in addition to a simple approval processes. For folks who qualify, it will take nothing you’ve seen prior you receive a loan render — for instance the interest rate and you may cost label. Due to the fact online personal bank loan loan providers services having smaller overhead, the eye cost would be contrary to popular belief reduced. And you can whether you have higher level borrowing otherwise poor credit, discover an unsecured loan for everyone.

One of our newest favorites try SoFi, with some of your own reduced rates of interest and you can individual-friendly regulations regarding the personal loan company.

Any type of choice you select, one which just come across alternatives so you can Financing You to personal loans, take the appropriate steps to increase your credit score. You can begin by paying down obligations. An excellent means to fix enhance your credit history is always to view your credit history for problems.

Working on your credit rating takes care of — practically. Advanced level borrowing from the bank can supply you with accessibility low interest signature loans and help save you various otherwise several thousand dollars.

The fresh new „right“ consumer loan depends on a few things, as well as your credit score and credit history. it hinges on the plans toward loan in addition to sort of loan you need. A consumer loan is one of well-known style of consumer loan, but a protected loan is a better option for people. By taking away a guaranteed mortgage, you will need to install a collateral, such as your household or vehicle. This may indicate you be eligible for better financing terms and conditions, your equity was at risk if you skip their monthly payment.

The great thing about unsecured loans is that you will find hardly restrictions how you utilize her or him. Like, specific signature loans try customized getting debt consolidation. An informed debt consolidation funds will save you currency because of the decreasing your own interest and you will/or payment. Harmony import credit cards can also be worth investigating. Almost every other finance could be appropriate to finance house home improvements otherwise shell out having scientific expenditures.

- The lender charge a low interest and low costs — if any charges whatsoever.

- The mortgage fees name works for you. It must be for a lengthy period to store the newest payment in balance, but quick sufficient to will let you spend the money for financing from easily.

- The lender is simple to work alongside and you will someone you could believe.

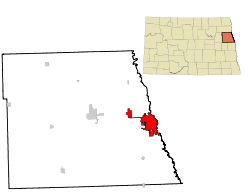

installment loans in Hudson IL with bad credit

After you come across a loan you to definitely clicks off the around three packages, you’ll end up on the right track to finding a solution in order to Funding One to unsecured loans.

You will find two huge financial institutions that don’t bring personal loans, potentially due to the fact margins are way too thin or perhaps the risks of unsecured loans are way too great.